iTrade

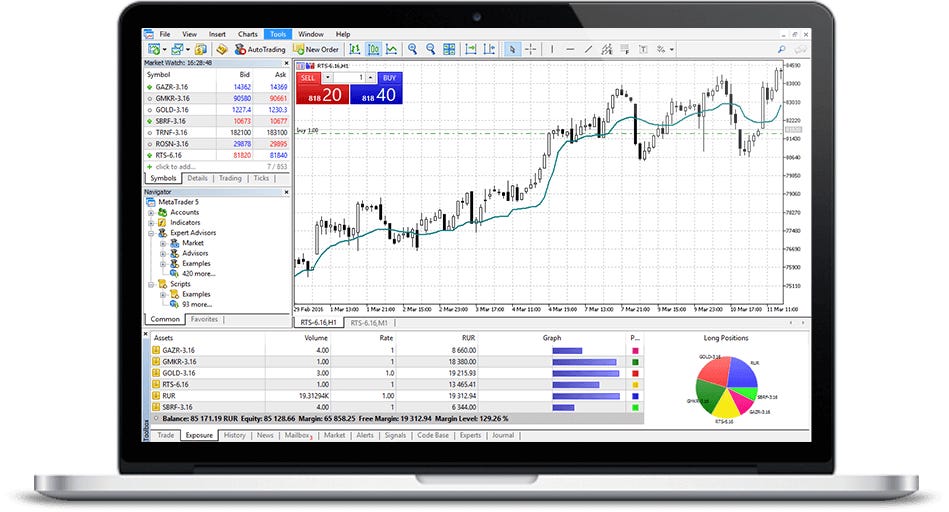

YOUR ULTIMATE METATRADER SOLUTIONS

A COMPLETE SOLUTION FOR STARTUP FOREX BROKERS

Unlike traditional Forex White Label solutions, our offering allows brokers not only to differentiate themselves from using their own name and logo, but also to use any liquidity provider, server, at broker’s choice.

SERVICES

iTrade provides a variety of innovative and comprehensive IT solutions. We deliver quality services in the most efficient way, and our experts will work collaboratively with you to customize our offerings to your particular needs. Book a meeting with one of our consultants to hear more about how we can assist your operation.

Our team has a lot of experience with liquidity and risk management, trading systems, reliability engineering, and high-performance parallel programming. And we would be happy to help you earn money by applying our skills.

SOFTWARE PROJECT

Get in touch

We always want to hear from you at iTrade. Contact us today to find the customized IT solutions that best fit your needs.